The Changing Vaccine Development Landscape

Fresh approaches for novel modalities and delivery

Not too long ago vaccines were the riskiest and least profitable sector in pharmaceuticals / biopharmaceuticals. A much-improved legal / regulatory climate was at least partly responsible for the explosion in vaccine R&D, and for rising demand as well. 2013 worldwide demand for communicable disease vaccines, $25 billion, has more than doubled in less than a decade, to more than $61 billion, a figure projected to grow by more than 10% per year through 2028. Of the more than 100 vaccines approved for US markets, all but three were designed to prevent communicable or infectious diseases.

Yesterday’s technologies

Vaccines work by exposing patients’ immune systems to precisely-dosed quantities of an antigen. Which antigen to use, and how to present it to the immune system, depends on many factors, including the pathogen, its immunogenicity, the disease, and the product’s manufacturability.

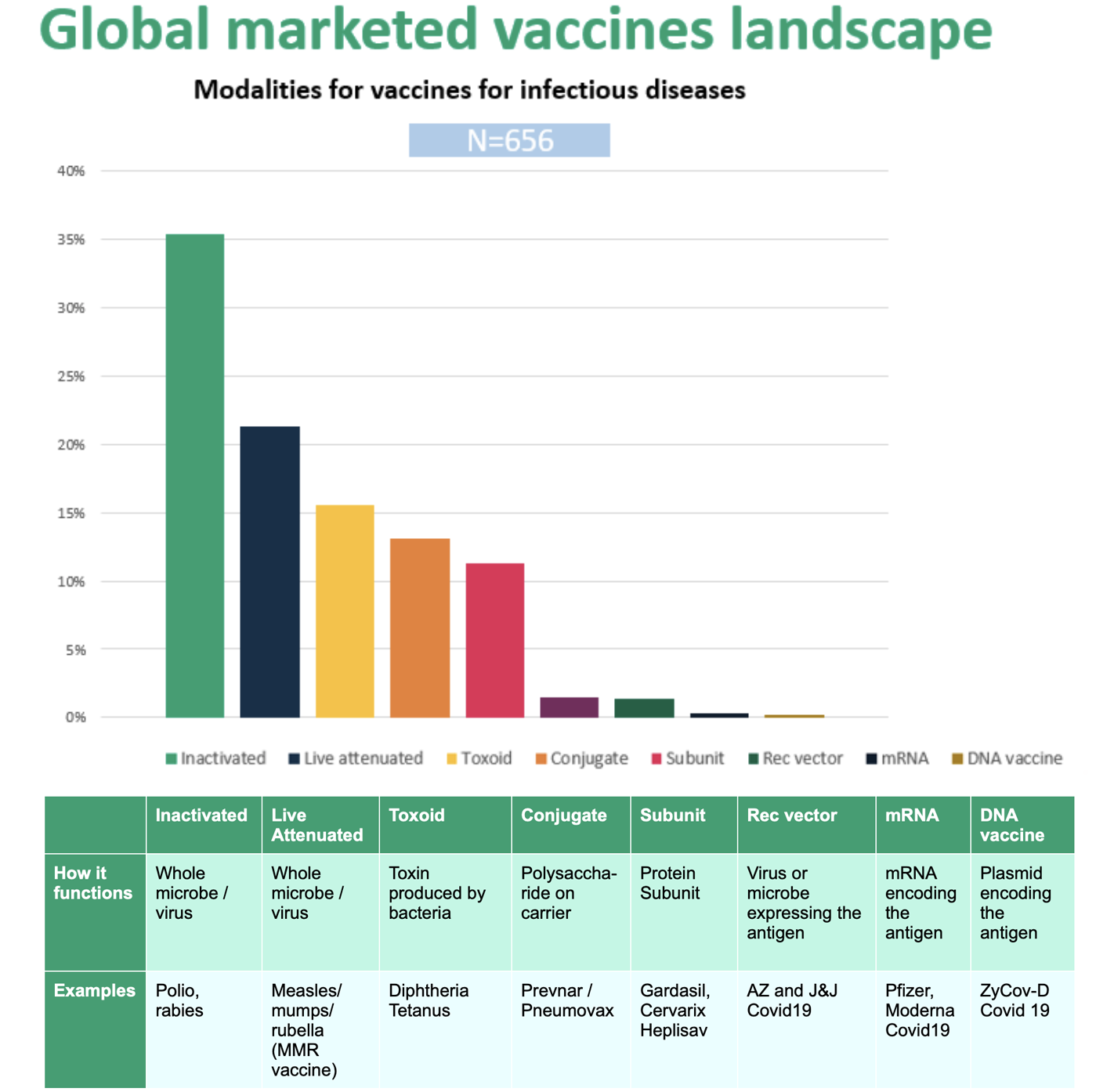

Figure 1. illustrates the types of vaccines currently marketed globally. More than one third of approved products use “inactivated” organisms, followed by live attenuated, toxoid, conjugate, and subunit vaccines. With the notable exception of COVID-19 vaccines very few are based on recombinant vector, mRNA, or DNA technologies.

The whole-organism derived vaccine technologies, optimized over many decades, represent the majority of vaccine technologies in current use. Contract manufacturers who maintain these capabilities will continue to meet the needs of vaccine developers for the next several years, but emerging vaccine technologies demand a new set of competencies. While some assays, production steps, and quality assurance measures will remain relevant, currently employed development and manufacturing strategies cannot support many of today’s development-stage projects.

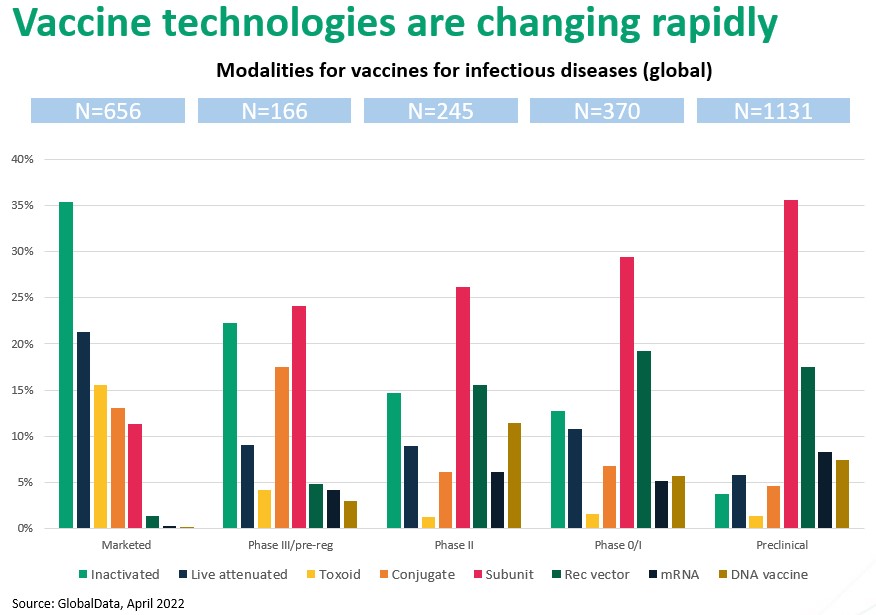

Figure 2. The vaccine landscape is rapidly changing from predominantly whole-organism based to recombinant and vector based. Nucleic acid based is up-and-coming.

Figure 2. illustrates the remarkable paradigm shift occurring in vaccine development. As you move to the right, through “Phase III” to successively earlier development stages, the trend away from live-organism technologies to molecular (recombinant, vector, nucleic acid) immune modulation is unmistakable.

For example, inactivated and live attenuated comprise nearly 60% of marketed vaccines, but if approval rates for vaccine types are approximately equal, fewer than 10% of vaccines approved at some point in the future will be based on intact organisms. Similarly, advanced vector and gene-based approaches barely register in today’s marketplace but will likely command approximately a 30% share in future approvals. Perhaps most strikingly, subunit vaccines, which make up just 12% of current approvals, will increasingly dominate future development pipelines and, we expect, approvals as well.

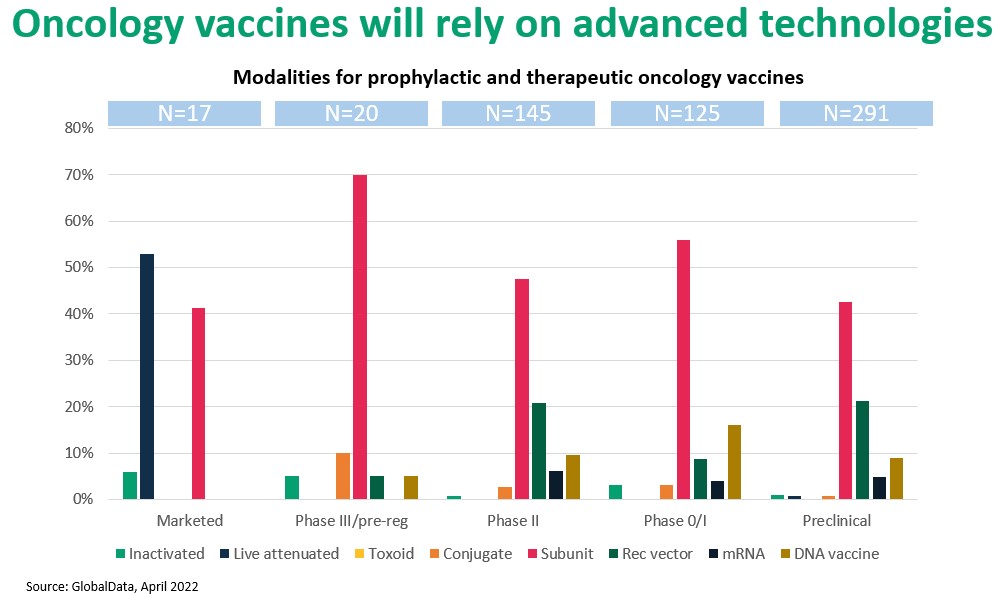

A similar pattern may be seen with cancer vaccines. The four currently U.S.-approved cancer vaccines, which prevent cancers associated with hepatitis B and human papilloma viruses, are traditional products that target the causative pathogens. By contrast, development-stage oncology vaccines are designed to treat or cure cancer. These vaccines are part of a larger therapeutic category, immunotherapies, that rely on complex mechanisms and advanced molecular constructs which lie outside the expertise of most CDMOs. Figure 3. suggests a shift from conventional antigen- and antigen-presentation methods to advanced strategies based on protein subunits, nucleic acid technology (including mRNA), and viral vectors.

Figure 3. Proteins (“subunit”) and vector-based vaccines dominate the oncology vaccines pipeline.

Strategic partnerships

Since much of the development and manufacturing of clinical-stage vaccines is outsourced or carried out through partnerships, developers seeking “technical expertise” and “manufacturing capacity” face genuine challenges. Given the competitive nature of the vaccine business, a conventional vaccine manufacturer may not have acquired the skills and cGMP production capacity to support the development and manufacturing for the coming wave of next- generation vaccines.

The prospect of revamping or redirecting development efforts around novel antigen expression, immune recruitment, and production platforms is daunting. Most sponsors will turn to a partner, a CDMO perhaps, but determining which competencies to seek out is not always clear.

Obviously, the terms “development” and “manufacturing,” as they relate to vaccines, cover a lot of ground. The vaccine landscape encompasses wildly diverse expression systems (RNA, DNA, and proteins), cultivation and purification methodologies, myriad cell types, reagents, feeds, and genetic constructs, several potential formulation options, plus delivery or Administration.

Part II of this series details the technologies behind next-generation vaccines and describes two technologies supporting the dominant types of current early development-stage vaccines: recombinant proteins and novel viral vectors. We also outline challenges facing developers and how to overcome them through effective CDMO partnerships.

CDMO PARTNER FOR LIFE

With broad and deep expertise in vaccines development and a global manufacturing network, we provide competitive advantage and business value.

Contact us to learn how we can accelerate your vaccine development and commercialization.

REFERENCES

1 Douglas RG, Samant VB. The Vaccine Industry. Plotkin’s Vaccines. 2018:41–50.e1. doi: 10.1016/B978-0-323-35761-6.00004-3. Epub 2017 Jul 17. PMCID: PMC7151793.

2 Fortune Business Insights. “Vaccines Market Size, Share, and COVID-19 Impact Analysis. Accessed at https://www.fortunebusinessinsights.com/industry-reports/toc/vaccines-market-101769, August 20, 2022.

3 U.S. Food and Drug Administration. “Vaccines Licensed for Use in the United States.” Accessed at https://www.fda.gov/vaccines-blood-biologics/vaccines/vaccines-licensed-use-united-states on August 20, 2022.